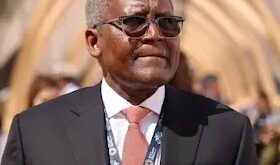

FBN’s Chief Executive Officer, Dr. Adesola Adeduntan, plans to get on board its agent money platform up to 500,000 operators to improve access to finance and enhance financial inclusion in the country.

FBN’s Chief Executive Officer, Dr. Adesola Adeduntan, plans to get on board its agent money platform up to 500,000 operators to improve access to finance and enhance financial inclusion in the country.

Adeduntan said this at the opening ceremony of the 12th Annual Conference of the Chartered Institute of Nigerian Bankers (CIBN) in Abuja, saying that the bank would engage 500,000 agents across the country to ensure that its financial services become accessible to a lot of Nigerians.

The CIBN conference had as its theme: “the future of the Nigerian banking industry – 360”. It had Adeduntan at the chairman of the organising committee.

In his remarks, Adeduntan said First Bank would support all effort to ensure effective financial inclusion in Nigeria.

He added: “We have a very ambitious plan to appoint about 500,000 agents across the nook and cranny of our country and to ensure that banking facilities and services are made available to our people.”

Adeduntan noted that the banking sector in Nigeria remained the primary partner to the government with regards to economic growth and development in the country, adding that, “If we do not interrogate those opportunities and mainstream them properly, the country and the entire economy will be left behind.

“In 2017, the FBN launched its agent money banking which it called ‘the Firstmonie Agent’ and described it as the ‘Human ATM’ empowered to reduce the reliance on over-the-counter transactions while providing convenient personalised services.”

Adeduntan explained that the Firstmonie agents were equipped to carry out services which included account opening; cash deposit; airtime purchase; bills payment; withdrawals and money transfer.

According to the bank, FirstMonie Agents are usually owners of small businesses within communities with limited or no banking penetration, who have been enlisted on its network across the country.

Startrend International Magazine For Your Latest News And Entertainment Gists

Startrend International Magazine For Your Latest News And Entertainment Gists