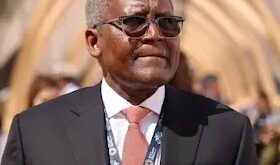

The Group Managing Director and Chief Executive Officer of United Bank for Africa Plc (UBA), Kennedy Uzoka, has addressed the controversy generated by bank charges for Automated Teller Machine, ATM, transactions.

Speaking on the sideline of UBA Annual General Meeting held at the Eko Hotels & Suites in Victoria Island, Lagos, Uzoka said Nigerian banks charge customers for ATM transactions due to the cost of owning these ATMs in Nigeria.

According to Uzoka, the absence of ATM manufacturing firms in Nigeria (and Africa at large) makes the cost of purchasing the product to be on the high side.

He also noted that the lack of stable electricity in the country negatively impacts the cost of running the ATMs.

He explained that such charges are not experienced in foreign countries because the process of ordering for ATMs is easy.

Moreover, foreign banks do not depend on alternative power supply to run their ATMs.

“The ATM business in Nigeria requires a lot of reviews. You Know, those who say that you withdraw the charges need to understand that we are in a peculiar environment,” Uzoka said.

He added, “We all go abroad, UBA operates in London for instance and wants to put an ATM, we just tell the ATM provider, get a space, you put the ATM, everything is there. In Nigeria, you buy an ATM, you pay import duties to bring it because they come from abroad, we don’t manufacture ATM in Africa.

“Three, you have to put power, sometimes, you have two generators, inverters, these all cost money. But we in the industry believe we need to serve our customers, so ATM is not a profitable business for us, but we believe at some point, it will be reconsidered.”

Uzoka, however, said the removal of ATM charges won’t affect the bottom line of UBA.

According to him, the deployment of ATM across UBA branches is for customers to experience fast and better service.

“If you remove the little charge—because as today, customers can do three transactions without being charge—I don’t think that will affect our bottom line. Because we in UBA see ATM as a channel to make our customers happy. So whatever will make our customers happy will make them patronize us more,” Uzoka said.

UBA’s Profit Before Tax (PBT) hit NGN106.76 billion while the Profit After Tax (PAT) settled at NGN78.60 billion for the financial year ended December 2018

Startrend International Magazine For Your Latest News And Entertainment Gists

Startrend International Magazine For Your Latest News And Entertainment Gists